Category Archive: Money Related

-

David England: A Rare Buy Recommendation

Comments Off on David England: A Rare Buy RecommendationIt is always nice to receive complements, but when it comes from a well-known Columnist of the Southern Illinoisan – Business Journal, Retired Associate Professor of Finance and Financial Icon/Founder of DavidOEngland.com in my hometown, it means MUCH more!

Please check out his kind words and the reasons he recommends “MoneyBags: A Guide to Teaching Your Kids About Money” as a must buy this holiday season.

Thank you David England for your support, teaching, and wisdom over the years.

Here is to filling your MoneyBags!

-

It is Tax Time……..I mean Spring Time

Comments Off on It is Tax Time……..I mean Spring TimeFor most people this time of year always makes them happy, since they know that summer is around the corner. However, for me, I don’t start celebrating until after tax day (April 15th – unless there it falls on a weekend or a holiday).

So, since it is Tax Time, take a minute to teach your kids about money and taxes. As stated in Chapter 11, one of the fastest ways for kids to understand the impact of taxes is for you to take some “taxes” out of their food with a big bite for the provider (you).

Furthermore, explain where money comes from and that it does not grow on trees (Chapter 47), which was my favorite dream. Consider kicking spring off with some MoneyBags fun by creating a Money Tree. Erect it up on Aril 2nd (the enactment of the 1792 Money Law), decorate it and then take it down on Tax Day!

Make sure to post a pic of your Money Tree on Facebook, I would love to see it.

Here is to filling your MoneyBags!

Wendy

-

MoneyBags E-Book – The Joy of Delayed Gratification Strikes Again!

Comments Off on MoneyBags E-Book – The Joy of Delayed Gratification Strikes Again!After much delay, MoneyBags has entered the 21st century!!!!

I am most excited to tell you that it is official, you can now buy “MoneyBags: A Guide to Teaching Your Kids About Money” as an EBook for $9.99! As a person from the “old school,” I have always enjoyed holding and reading a physical book. However, I am surprised that I really like the EBook too.

I found the whole process rather easy. I made MoneyBags my first purchase (of course) and I am impressed at how crisp and easy it is to read. Furthermore, I like that you simply swipe to turn a page and that there are hyperlinks take you to the chapter or website with a simple click. You can navigate back and forth to different chapters via the table on contents. Plus, I can also change the font style, font size, line spacing, background color, margins, and brightness for my desired reading pleasure.

Furthermore, most people carry their electric devices everywhere, so now it is super easy to walk through a quick chapter with your kids when you are waiting at the airport, on a long car ride, or simply waiting for you meal at a restaurant.

For your MoneyBags Mission, please take a peek at the new EBook, rate it in the “Before You Go” section, and tell a friend!

Here is to filling your MoneyBags!

Wendy

-

The Importance of Using Cash

Comments Off on The Importance of Using CashI watched a fabulous documentary called “(Dis) Honesty: The Truth About Lies” featuring Professor Dan Ariely’s lifelong work. Many great insights came out of his research, one of which is that dishonesty grows the further one is away from actual money.

In the documentary, Professor Ariely performs a matrix study which has people take a test where compensation is received at the end based on the honor system. The subjects take a test and are given the key to the test so they can see and report how many questions they answered correctly. The subject was then asked to shred their test and answers (or so they think). Once their test was “shredded” they then proceeded to a test monitor to report how many answer they got correct and then rewarded with money accordingly (i.e. the more correct answers, the more money they received for their time). In this study, they found that people “fudged” their results by one or two answers. If they had four correct, they likely reported six.

He then does the same matrix study, but this time after shredding their test instead of proceeding directly to the monitor for cash, they were given poker chips. Then, they would proceed three feet away to the “cashier” to turn their poker chips in for cash. What he found was that this ever so slight distancing from the money doubled the “fudge factor” in how many correct answers people were willing to report. If they had four correct, they were now willing to “fudge” more and report eight correct answers.

So, he tries the study one more time, but this time, he has people do a pre-test of writing down as many of the Ten Commandments as they can remember, or swear on a Bible. In this scenario, the number of people being honest in their reported test results increased to 100%! He even tested people of other religions and atheists to see if it would yield similar results, and the results held true. The conclusion is that a simple reminder of one’s own general moral code will lead to more honest behavior bmmhzdx.

Professor Ariely’s study shows that being reminded of moral behavior and keeping it top of mind can have huge impact on behavior. As an example, one country made one small change on the letter they sent out to collect back taxes. The simple little line of “nine in ten people pay their taxes on time” increased their collection rate by 5%, which sounds like a nominal number, but for a large country it means big money!

Thus, your MoneyBags Mission is to share this blog’s link with a friend and then watch Professor Ariely’s documentary “(Dis) Honesty: The Truth About Lies” with your kids. The program is currently on Netflix or is available for download on iTunes, GooglePlay or Vimeo. After watching, discuss as a group what the implications of this research means for your family as well as each individual and how it might influence your behaviors toward money as we use more debit, credit and online currencies. Perhaps you can come up with your own family’s Code of Honor to keep in your wallets, backpacks and hang on a wall. The Family Code of Honor will be a good nudge to remind everyone to always be honest and use good financial sense.

Here is to filling your MoneyBags!

Wendy

-

Taylor Swift gets an A+ for waking up Apple!

Comments Off on Taylor Swift gets an A+ for waking up Apple! Chapter 43 talks about PROFIT. This word people often feel the need to say in a whisper, since so many people have made them feel unclean for wanting to make a profit on their creativity and hard work. The freedom to pursue profit is what makes the American Dream become a reality. Today Taylor spoke up for herself and other artist, when Apple decided that they would not pay any of the artists their royalties for the three month trial period of their new streaming service, which they will charge $10 a month. In her words, Taylor explained to Apple “….with all due respect, it’s not too late to change this policy and change the minds of those in the music industry who will be deeply and gravely affected by this. We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”

Chapter 43 talks about PROFIT. This word people often feel the need to say in a whisper, since so many people have made them feel unclean for wanting to make a profit on their creativity and hard work. The freedom to pursue profit is what makes the American Dream become a reality. Today Taylor spoke up for herself and other artist, when Apple decided that they would not pay any of the artists their royalties for the three month trial period of their new streaming service, which they will charge $10 a month. In her words, Taylor explained to Apple “….with all due respect, it’s not too late to change this policy and change the minds of those in the music industry who will be deeply and gravely affected by this. We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”As you shop, remember your local business owner. Think about how bleak shopping would be if these unique stores cease to exist because they cannot make a profit. Imagine just a sea of Wal-Mart’s or only Amazon on the internet. This country actually has laws to avoid Monopolies since it kills competition in price and selection. When you think about mom and pop store prices being high, stop and ask yourself, why? Mom and pop store owners, up and coming artist, and inventors that are trying to get the word out, need small platforms to launch their ideas. Taylor Swift did not start out as a millionaire and Apple forgot that they started out of a garage of a young computer innovator. Gratefully, Taylor reminded them of the big picture and they have since agreed to see things as she does.

Three cheers to Taylor………Hip hip horary, hip hip hooray, hip hip hooray

Here is to filling your MoneyBags!

-

A MoneyBags Radom Act of Kindness

1 Comment4hlj3gn418

-

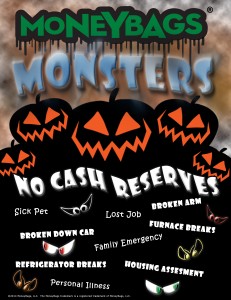

Beware the MoneyBags Monsters!!!!

Comments Off on Beware the MoneyBags Monsters!!!!It is almost here. The spookiest time of year……………Halloween!!!

When I reflect back on my childhood memories of this creepy holiday, I have several memories. As a kid, what a cool day! Not only do you get to dress up as your favorite character, but you go knocking on doors for free CANDY!!! Plus, for several years I would march in a night parade with my baton group. We had cool glow sticks taped onto our batons so people could see our awesome skills and the older girls twirled FIRE! I always liked this parade, well, that is until the one year the grim reaper came up from behind and scared me of out my shoes! Then, going forward, I was super skittish and always checking over my shoulder for creepers.

As I got older, the holiday just kept getting scarier. When I was in high school, Southern Illinois was the Halloween capital team project management tools. Every year, they would have a record breaking number of people make the trip down to SIU’s campus for their street party. I loved walking through the crowds looking at all of the costumes and just the sheer number of people that came for the holiday. I am excited all over again, since I have found the Disney of haunted hayrides – The Dead End Hayride in Wyoming, Minnesota. Last week I enjoyed the scary and creepy hay ride and maze.

As an advisor, when Halloween arrives, I think of the Money Monsters! Money Monsters are the sneaking creepy things that seem to take money out of your pocket, such as a car that breaks down, or a sick pet that needs to go to the vet. Sometimes, it may be a lost job, or maybe medical bills. The good news is, like garlic for a vampire or a night light for the ghosts in the closet, the best way to chase away the Money Monsters is to build a good cash reserve. Once you have a pool of money set aside for the unexpected surprises, like the grim reaper that scared me, if you are prepared (looking over your shoulder), it makes the Money Monsters look like someone dressed up in a costume.

Parents, this is a great time of year to sit down with your kids and walk them through the Money Monsters and the power that cash reserves has over them. To help your kids anchor this lesson, consider taking some time out of your busy schedule and play a board game that involves money (Chapter 14), such as Monopoly, Pay Day, or Life. As you play the game, talk to them about the amount of cash that they have and to plan ahead for problems that they may run into in a couple of turns. To ensure that the games teach good money habits, make sure to click on the Resources tab and print off the MoneyBags game tweaks.

Here is to filling your MoneyBags!!!

Wendy

-

My Sister’s MoneyBags Moment

Comments Off on My Sister’s MoneyBags Moment<img class="alignleft" style="width: 269px; height: 189px;" alt="MoneyBags Moment, Pennies" src="http://moneybagslife best team management apps.com/wp-content/uploads/2014/04/4-20BlogPic-300×238.jpg” width=”300″ height=”238″ />My sister has a rewarding job, as a Foster Care Case Manager working directly with foster kids, but today I got a frustrated text from her asking for some wisdom. Basically, one of her foster kids traded two video games ($50) for a bag of chips ($1) and of course she felt he got a bad deal. Did he? I think he was hungry and negotiated with something that did not meet his primary needs (The Plate Level of the Money Hierarchy Cake – Chapter 7). So for him, it was better to eat than to keep the games.

However, I also see my sister’s concern and desire to help, protect, and nurture him. I told her that this is a cheap mistake. It’s a MoneyBags Moment. She now needs to explain to him that both items have a dollar value and she needs him to understand the dollar amount of each item. A poor trade is one bag of chips ($1) for two video games ($50). A fair trade would be 50 bags of chips ($50), for the two games ($50), a good trade is 60 bags of chips ($60), and an awesome trade would be for a semi-truck full of chips ($1500). The sooner he learns this the better he will be a making deals (Chapter 46- Bartering).

Here is to filling your MoneyBags!

Wendy

-

Delayed Gratification — MoneyBags is printing as I type!

Comments Off on Delayed Gratification — MoneyBags is printing as I type!

I started this unexpected journey in early 2009. I was surprised when I saw a good friend, who was smart and a good parent, but he struggled when teaching his kids the basics in how to handle and think through money decisions. I then looked back at his upbringing and it all made sense, he only knew what he was taught by his parents and he was passing his limited knowledge on to his kids. So, I began feverishly writing all the things that I had learned. The lessons just poured out one right after another. Pages and pages of money lessons, but then I ran into a couple of problems, there is so much to know and how do I organize the information? More importantly, how do I make it simple and fun?

I then went to my good friend and executive coach at the time, Nancy Imholt, and explained to her this need I had in writing this book. She listened, smiled and got it! She saw a bigger vision than I could at the time. Then my passion became a dream.

I spent my spare time over the next couple of years, writing, researching, obtaining feedback, making changes, began blogging, and focusing on completing the book. At times, the finished product seemed so close, but then there would be a setback, from having no time for writing, to editors that did not connect to me or my vision. Through Nancy, I found my publisher, which linked me up to key people to help me through the process from editors to book designers, and so on. I also had to seek out people on my own to design the logo, web site, illustrations, and other countless tasks.

I was also blessed with cheerleaders. Many of my friends and colleagues have been encouraging, positive, and even anxious as they look forward to the completion of the book I have been talking about for so long. Carlos Rodriguez and Amber Appel have been my biggest supporters. They joined MoneyBags LLC, even though there is not a penny of profit. Their help, input and support is priceless! Also, my future success of the book now depends on me being able to take a little more time away from the office, so I am grateful for Carla Keck, who is my right hand and has my back at every turn. With her at the wheel, I can confidently take time to spread my vision.

So, after many years and numerous edits, within in a few short days the book will be complete. The website will be live. I feel like a little kid at Christmas. I am about to burst from the excitement and anticipation of the long awaited arrival of MoneyBags in my hands. Oh, the overwhelming feeling of delayed gratification! This important money lesson is covered in Chapter 25 of the book. It talks about the famous researcher, Walter Mischel, and his marshmallow test. It explains his findings and the importance of having self-discipline to not always grab, but to realize the bigger reward for waiting.

Here is to filling your MoneyBag!

Wendy

-

The Cost of Clutter and Explaining it to your Kids

Comments Off on The Cost of Clutter and Explaining it to your Kids

Money Manifesters!!!

Today I was reading a great article by Amanda Enayati titled “Why Clutter Matters and De-cluttering is Difficult.” In the article, she states that clutter is expensive and costs an average of $10 per square foot just to store items. Approximately 10% of the population spends $1,000 a year on storage units. Of the people that have two car garages, 25% are too full for the owners to their park cars! Sadly, 23% of people pay bills late and incur fees due to misplaced/lost statements. Overall, an average American spends a year of their life looking for misplaced items. Explain the cost of clutter to your kids.

As a fun exercise, go a step further with your kids and talk about all the “stuff” in your garage/basement. Ask them to think about how much you paid for all that “stuff!” Make a game of it. Pick out 10-30 items and have everyone write on a sheet of paper, what they think was spent on all of the items in total. Then make the game into a scavenger hunt. Have your kids make a list of all the “stuff” in your garage/basement (the items that you have picked out). (Note: Each kid can have the same lists or you can have them look for separate items.) Then go to the store(s) and have the kids locate and write down the price of the different items. For example, maybe your list has four lawn chairs, two bikes, grill, lighter fluid, coals, five gallons of paint, potting soil, 25 planting pots, lawn mower, etc. After your trip, have your kids total up their lists and see who was closest to the total guess that was written on the paper. Ask them what they learned like this. Were they surprised at the cost of all the stuff? How much would you have to pay in taxes? Calculate tax of 5%, 8%, and 10%. How often is the stuffed used? Is the “stuff” in good shape or has it been damaged or neglected? How many weeks would it take your kids to save their full allowance to pay for all that “stuff” (including taxes 10%)? How would it feel to have the money spent on all the “stuff” inside their MoneyBag instead?

Here is to filling your MoneyBag!

Wendy