Category Archive: Delayed Gratification

-

MoneyBags E-Book – The Joy of Delayed Gratification Strikes Again!

Comments Off on MoneyBags E-Book – The Joy of Delayed Gratification Strikes Again!After much delay, MoneyBags has entered the 21st century!!!!

I am most excited to tell you that it is official, you can now buy “MoneyBags: A Guide to Teaching Your Kids About Money” as an EBook for $9.99! As a person from the “old school,” I have always enjoyed holding and reading a physical book. However, I am surprised that I really like the EBook too.

I found the whole process rather easy. I made MoneyBags my first purchase (of course) and I am impressed at how crisp and easy it is to read. Furthermore, I like that you simply swipe to turn a page and that there are hyperlinks take you to the chapter or website with a simple click. You can navigate back and forth to different chapters via the table on contents. Plus, I can also change the font style, font size, line spacing, background color, margins, and brightness for my desired reading pleasure.

Furthermore, most people carry their electric devices everywhere, so now it is super easy to walk through a quick chapter with your kids when you are waiting at the airport, on a long car ride, or simply waiting for you meal at a restaurant.

For your MoneyBags Mission, please take a peek at the new EBook, rate it in the “Before You Go” section, and tell a friend!

Here is to filling your MoneyBags!

Wendy

-

An Example of Modern Day Delayed Gratification

Comments Off on An Example of Modern Day Delayed Gratification Recently I got into the video game Hidden City. This game is a ton of fun for someone like me that enjoys finding hidden things. Before I got too deep into the game though, I read reviews and heard a common theme that a player HAS to BUY energy, rubies, and other key “pieces” in order to progress. After reading this, I decided to challenge this theory. I was going to play without spending any money ….of course!

Recently I got into the video game Hidden City. This game is a ton of fun for someone like me that enjoys finding hidden things. Before I got too deep into the game though, I read reviews and heard a common theme that a player HAS to BUY energy, rubies, and other key “pieces” in order to progress. After reading this, I decided to challenge this theory. I was going to play without spending any money ….of course!So, as I write this blog post, I have made it to level 20 without a single purchase! For me, it is perfect that I run out of energy and the game puts me into a “play timeout”. This forced timeout makes me have do something else vs. spending an entire day gaming. This “forced timeout” is a great example of delayed gratification as I am limited in the amount I can play, which makes me appreciate the time that I can play all that much more. An added bonus is I also don’t lose my entire day playing a game. Furthermore, I love the fact that I have not spent any money too. At one point I needed a crystal to put a collection together (sorry non-gamers – imagine finding a four-leaf clover, it’s very rare) and I had to keep repeating this one part of the game over and over. Failure after failure, it was driving me crazy. I can see how easy it would be to buy my way out of it, but instead, I practiced patience and persisted through it. You should have seen my celebration dance when I finally got a crystal! I wouldn’t have had this amazing feeling of accomplishment if I just purchased a crystal.

So parents, if your kids are gamers, that is ok, but don’t let them spend money. Let them earn their game trophies by being patient and at the same time they will learn delayed gratification. Appreciating delayed gratification will help them as they master the skills of Financial saving and independence.

Here is to filling your MoneyBags!

-

We Made Our Goal! Speaking of Goals…

Comments Off on We Made Our Goal! Speaking of Goals…<a href="http://moneybagslife click resources.com/wp-content/uploads/2015/01/MB-New-Years-.jpg”>

Thank you all! Thanks to you, MoneyBags reached its goal of 200 Facebook Likes by midnight on December 31, 2014! This shows the power of goal setting. With that in mind, the following statistics from Personalplan.com1, quoting a Harvard Business study, sheds light on the power of goals.

- 83% of the population does not have goals

- 14% have a plan in mind, but are unwritten goals

- 3% have goals written down

The study found that the 14% who have goals are 10 times more successful than those without goals. The 3% with written goals are 3 times more successful than the 14% with unwritten goal.

When thinking about goals, Dr. Edwin Locke’s theory of SMART goal setting is quite valuable and can help you create your goals. Under his theory, your goals should be Specific, Measurable, Attainable, Relevant, and Time sensitive.

So, in 2015, here is your MoneyBags Mission: Welcome 2015 by thinking about what financial goals you would like to accomplish and write them down SMART-ly. Then, talk to your kids about setting up and writing down their SMART goal for 2015! Don’t forget to check in on your goals periodically throughout the year to see where you are in accomplishing them.

Here is to filling your MoneyBags!!!1http://www.personalplan.com.au/2_PersonalPlan/Goal_setting_Facts/index.html

-

Surviving Cancer and the Money Hierarchy Cake

Comments Off on Surviving Cancer and the Money Hierarchy Cake Since my book was published, much has happened as the months have ticked away. You may have noticed that my blog posts have been rather sporadic. It was my intent to at least connect with you monthly, but as we all know, life happens. The day that I receive the first copy of MoneyBags in my hand, during my celebratory lunch, I received a call from my doctor who informed me that I had several worrisome abnormal lymph nodes in my chest. This did not come as a large surprise, since the doctor had been running several test on me to find out what was causing my weak vocal cord, which in turn, caused my voice to drop down to a whisper. As she ruled things out, it finally became clear that I had Lymphoma.

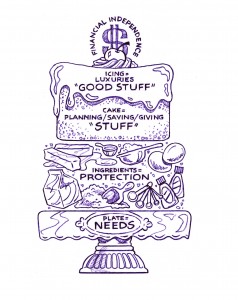

Since my book was published, much has happened as the months have ticked away. You may have noticed that my blog posts have been rather sporadic. It was my intent to at least connect with you monthly, but as we all know, life happens. The day that I receive the first copy of MoneyBags in my hand, during my celebratory lunch, I received a call from my doctor who informed me that I had several worrisome abnormal lymph nodes in my chest. This did not come as a large surprise, since the doctor had been running several test on me to find out what was causing my weak vocal cord, which in turn, caused my voice to drop down to a whisper. As she ruled things out, it finally became clear that I had Lymphoma.After I was diagnosed, I took a step back and was grateful for all the insurance (ingredients) I purchased on myself for such a scenario. Chapter 7 talks about the Money Hierarchy Cake. Level 2 is the Ingredients Level, which is where you pick up insurance. I immediately began taking an inventory of my insurance. Not only did I look at medical, but also life, and disability insurance. It should be no surprise to you, but I am also glad that I have my “old lady insurance” (i.e. long term care) in place too. Working in the insurance industry, it is hard for me to comprehend that my health went from super preferred nonsmoker (the best health rating) to uninsurable (not eligible for coverage) over night.

Like everyone else, I don’t like dishing out the money to pay for the insurance premiums, thinking I would never use it. However, logically I knew it was better to pay the premiums than to have something happen and no coverage in place.

As I reviewed all of my policies in detail, I can tell you that I had peace of mind knowing that if I had to walk away from being a financial advisor and unknown author, that financially, I was going to be just fine. Furthermore, I looked at what would happen if I were to die. Sadly, I don’t have kids, it was not in the cards for me, but I do have a substantial amount of life insurance on me for many reasons. I always joke with my clients that if I die young (when my insurance premiums are cheap) that someone should win the lottery. When I review the beneficiary designation on my life insurance policies, I think about what an impact I can make on where I decide to distribute the money. Even though my parents don’t need the money, I can ensure that they will not need money if I am gone. I have some charities that I allocate to as well as people who are important to me.

Gratefully, I am happy to report that not only am I now cancer free after six rounds of chemo therapy, but I also have regained my voice. Going forward I have a lot of ground to cover. I am looking forward, with your help, in helping parents teach their kids about money, by spreading the word about MoneyBags!

Here is to filling your MoneyBags!!!

Wendy

-

Tetherball of Success – A New MoneyBags Moment

Comments Off on Tetherball of Success – A New MoneyBags Moment As I write this I have a HUGE smile on my face. I am sitting on the porch listening to my neighbors (both parents and kids) laughing as they play with the new tetherball in their backyard. This tetherball is very special, since they told me that they bought it with their Family Saving Jar money (Chapter 2)! Woohoo! Way to save that change and create a MoneyBags Moment!

As I write this I have a HUGE smile on my face. I am sitting on the porch listening to my neighbors (both parents and kids) laughing as they play with the new tetherball in their backyard. This tetherball is very special, since they told me that they bought it with their Family Saving Jar money (Chapter 2)! Woohoo! Way to save that change and create a MoneyBags Moment!

-

Delayed Gratification — MoneyBags is printing as I type!

Comments Off on Delayed Gratification — MoneyBags is printing as I type!

I started this unexpected journey in early 2009. I was surprised when I saw a good friend, who was smart and a good parent, but he struggled when teaching his kids the basics in how to handle and think through money decisions. I then looked back at his upbringing and it all made sense, he only knew what he was taught by his parents and he was passing his limited knowledge on to his kids. So, I began feverishly writing all the things that I had learned. The lessons just poured out one right after another. Pages and pages of money lessons, but then I ran into a couple of problems, there is so much to know and how do I organize the information? More importantly, how do I make it simple and fun?

I then went to my good friend and executive coach at the time, Nancy Imholt, and explained to her this need I had in writing this book. She listened, smiled and got it! She saw a bigger vision than I could at the time. Then my passion became a dream.

I spent my spare time over the next couple of years, writing, researching, obtaining feedback, making changes, began blogging, and focusing on completing the book. At times, the finished product seemed so close, but then there would be a setback, from having no time for writing, to editors that did not connect to me or my vision. Through Nancy, I found my publisher, which linked me up to key people to help me through the process from editors to book designers, and so on. I also had to seek out people on my own to design the logo, web site, illustrations, and other countless tasks.

I was also blessed with cheerleaders. Many of my friends and colleagues have been encouraging, positive, and even anxious as they look forward to the completion of the book I have been talking about for so long. Carlos Rodriguez and Amber Appel have been my biggest supporters. They joined MoneyBags LLC, even though there is not a penny of profit. Their help, input and support is priceless! Also, my future success of the book now depends on me being able to take a little more time away from the office, so I am grateful for Carla Keck, who is my right hand and has my back at every turn. With her at the wheel, I can confidently take time to spread my vision.

So, after many years and numerous edits, within in a few short days the book will be complete. The website will be live. I feel like a little kid at Christmas. I am about to burst from the excitement and anticipation of the long awaited arrival of MoneyBags in my hands. Oh, the overwhelming feeling of delayed gratification! This important money lesson is covered in Chapter 25 of the book. It talks about the famous researcher, Walter Mischel, and his marshmallow test. It explains his findings and the importance of having self-discipline to not always grab, but to realize the bigger reward for waiting.

Here is to filling your MoneyBag!

Wendy