Category Archive: Book Related

-

David England: A Rare Buy Recommendation

Comments Off on David England: A Rare Buy RecommendationIt is always nice to receive complements, but when it comes from a well-known Columnist of the Southern Illinoisan – Business Journal, Retired Associate Professor of Finance and Financial Icon/Founder of DavidOEngland.com in my hometown, it means MUCH more!

Please check out his kind words and the reasons he recommends “MoneyBags: A Guide to Teaching Your Kids About Money” as a must buy this holiday season.

Thank you David England for your support, teaching, and wisdom over the years.

Here is to filling your MoneyBags!

-

Helping Our Four Footed Friends

Comments Off on Helping Our Four Footed FriendsMoneyBags will be at Retrieve a Golden of Minnesota (RAGOM) Goldzilla fund raising event on September 10th (8:30-2:00) at Long Lake Regional Park in New Brighton. Come enjoy the in helping raise money for this good cause. What could be more fun than sun, goldens and helping pets that need a home!

-

MoneyBags E-Book – The Joy of Delayed Gratification Strikes Again!

Comments Off on MoneyBags E-Book – The Joy of Delayed Gratification Strikes Again!After much delay, MoneyBags has entered the 21st century!!!!

I am most excited to tell you that it is official, you can now buy “MoneyBags: A Guide to Teaching Your Kids About Money” as an EBook for $9.99! As a person from the “old school,” I have always enjoyed holding and reading a physical book. However, I am surprised that I really like the EBook too.

I found the whole process rather easy. I made MoneyBags my first purchase (of course) and I am impressed at how crisp and easy it is to read. Furthermore, I like that you simply swipe to turn a page and that there are hyperlinks take you to the chapter or website with a simple click. You can navigate back and forth to different chapters via the table on contents. Plus, I can also change the font style, font size, line spacing, background color, margins, and brightness for my desired reading pleasure.

Furthermore, most people carry their electric devices everywhere, so now it is super easy to walk through a quick chapter with your kids when you are waiting at the airport, on a long car ride, or simply waiting for you meal at a restaurant.

For your MoneyBags Mission, please take a peek at the new EBook, rate it in the “Before You Go” section, and tell a friend!

Here is to filling your MoneyBags!

Wendy

-

The Importance of Using Cash

Comments Off on The Importance of Using CashI watched a fabulous documentary called “(Dis) Honesty: The Truth About Lies” featuring Professor Dan Ariely’s lifelong work. Many great insights came out of his research, one of which is that dishonesty grows the further one is away from actual money.

In the documentary, Professor Ariely performs a matrix study which has people take a test where compensation is received at the end based on the honor system. The subjects take a test and are given the key to the test so they can see and report how many questions they answered correctly. The subject was then asked to shred their test and answers (or so they think). Once their test was “shredded” they then proceeded to a test monitor to report how many answer they got correct and then rewarded with money accordingly (i.e. the more correct answers, the more money they received for their time). In this study, they found that people “fudged” their results by one or two answers. If they had four correct, they likely reported six.

He then does the same matrix study, but this time after shredding their test instead of proceeding directly to the monitor for cash, they were given poker chips. Then, they would proceed three feet away to the “cashier” to turn their poker chips in for cash. What he found was that this ever so slight distancing from the money doubled the “fudge factor” in how many correct answers people were willing to report. If they had four correct, they were now willing to “fudge” more and report eight correct answers.

So, he tries the study one more time, but this time, he has people do a pre-test of writing down as many of the Ten Commandments as they can remember, or swear on a Bible. In this scenario, the number of people being honest in their reported test results increased to 100%! He even tested people of other religions and atheists to see if it would yield similar results, and the results held true. The conclusion is that a simple reminder of one’s own general moral code will lead to more honest behavior bmmhzdx.

Professor Ariely’s study shows that being reminded of moral behavior and keeping it top of mind can have huge impact on behavior. As an example, one country made one small change on the letter they sent out to collect back taxes. The simple little line of “nine in ten people pay their taxes on time” increased their collection rate by 5%, which sounds like a nominal number, but for a large country it means big money!

Thus, your MoneyBags Mission is to share this blog’s link with a friend and then watch Professor Ariely’s documentary “(Dis) Honesty: The Truth About Lies” with your kids. The program is currently on Netflix or is available for download on iTunes, GooglePlay or Vimeo. After watching, discuss as a group what the implications of this research means for your family as well as each individual and how it might influence your behaviors toward money as we use more debit, credit and online currencies. Perhaps you can come up with your own family’s Code of Honor to keep in your wallets, backpacks and hang on a wall. The Family Code of Honor will be a good nudge to remind everyone to always be honest and use good financial sense.

Here is to filling your MoneyBags!

Wendy

-

An Example of Modern Day Delayed Gratification

Comments Off on An Example of Modern Day Delayed Gratification Recently I got into the video game Hidden City. This game is a ton of fun for someone like me that enjoys finding hidden things. Before I got too deep into the game though, I read reviews and heard a common theme that a player HAS to BUY energy, rubies, and other key “pieces” in order to progress. After reading this, I decided to challenge this theory. I was going to play without spending any money ….of course!

Recently I got into the video game Hidden City. This game is a ton of fun for someone like me that enjoys finding hidden things. Before I got too deep into the game though, I read reviews and heard a common theme that a player HAS to BUY energy, rubies, and other key “pieces” in order to progress. After reading this, I decided to challenge this theory. I was going to play without spending any money ….of course!So, as I write this blog post, I have made it to level 20 without a single purchase! For me, it is perfect that I run out of energy and the game puts me into a “play timeout”. This forced timeout makes me have do something else vs. spending an entire day gaming. This “forced timeout” is a great example of delayed gratification as I am limited in the amount I can play, which makes me appreciate the time that I can play all that much more. An added bonus is I also don’t lose my entire day playing a game. Furthermore, I love the fact that I have not spent any money too. At one point I needed a crystal to put a collection together (sorry non-gamers – imagine finding a four-leaf clover, it’s very rare) and I had to keep repeating this one part of the game over and over. Failure after failure, it was driving me crazy. I can see how easy it would be to buy my way out of it, but instead, I practiced patience and persisted through it. You should have seen my celebration dance when I finally got a crystal! I wouldn’t have had this amazing feeling of accomplishment if I just purchased a crystal.

So parents, if your kids are gamers, that is ok, but don’t let them spend money. Let them earn their game trophies by being patient and at the same time they will learn delayed gratification. Appreciating delayed gratification will help them as they master the skills of Financial saving and independence.

Here is to filling your MoneyBags!

-

Taylor Swift gets an A+ for waking up Apple!

Comments Off on Taylor Swift gets an A+ for waking up Apple! Chapter 43 talks about PROFIT. This word people often feel the need to say in a whisper, since so many people have made them feel unclean for wanting to make a profit on their creativity and hard work. The freedom to pursue profit is what makes the American Dream become a reality. Today Taylor spoke up for herself and other artist, when Apple decided that they would not pay any of the artists their royalties for the three month trial period of their new streaming service, which they will charge $10 a month. In her words, Taylor explained to Apple “….with all due respect, it’s not too late to change this policy and change the minds of those in the music industry who will be deeply and gravely affected by this. We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”

Chapter 43 talks about PROFIT. This word people often feel the need to say in a whisper, since so many people have made them feel unclean for wanting to make a profit on their creativity and hard work. The freedom to pursue profit is what makes the American Dream become a reality. Today Taylor spoke up for herself and other artist, when Apple decided that they would not pay any of the artists their royalties for the three month trial period of their new streaming service, which they will charge $10 a month. In her words, Taylor explained to Apple “….with all due respect, it’s not too late to change this policy and change the minds of those in the music industry who will be deeply and gravely affected by this. We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”As you shop, remember your local business owner. Think about how bleak shopping would be if these unique stores cease to exist because they cannot make a profit. Imagine just a sea of Wal-Mart’s or only Amazon on the internet. This country actually has laws to avoid Monopolies since it kills competition in price and selection. When you think about mom and pop store prices being high, stop and ask yourself, why? Mom and pop store owners, up and coming artist, and inventors that are trying to get the word out, need small platforms to launch their ideas. Taylor Swift did not start out as a millionaire and Apple forgot that they started out of a garage of a young computer innovator. Gratefully, Taylor reminded them of the big picture and they have since agreed to see things as she does.

Three cheers to Taylor………Hip hip horary, hip hip hooray, hip hip hooray

Here is to filling your MoneyBags!

-

MoneyBags, A Must Buy for Any Parent!

Comments Off on MoneyBags, A Must Buy for Any Parent!“A must buy for any parent…”, says David O task management for teams. England, host of Eye On the Market in his recent Market Minute. We are very excited and appreciate David’s support in our mission of helping parents teach their kids about money. If you agree with our Mission, please help us get the word out by sharing MoneyBags with your friends and family. Take a listen to the spot here:

To learn about David O. England, visit his website by clicking his logo below:

-

A MoneyBags Radom Act of Kindness

1 Comment4hlj3gn418

-

Mom’s Choice Award Winner

Comments Off on Mom’s Choice Award WinnerIt is official! “MoneyBags A Guide to Teaching Your Kids About Money” has won two Mom’s Choice Awards (MCA) – Gold , in both the Adult Books and Educational Products categories!

“The MCA evaluates products and services for children and parents. The program is globally recognized for establishing the benchmark of excellence in family-friendly media, products and services. The organization is based in the United States and has evaluated thousands of entries from more than forty countries.”

After a rigorous evaluation I am both honored and excited that MoneyBags received the highest awards in both categories entered. Going forward, the book and website can display their respected logo.

Thank you for all your support so early in my journey to education kids about money. Please help me spread the good news by sharing this post via Facebook, Twitter and Pinterest!

Here is to filling your MoneyBags!

Wendy

-

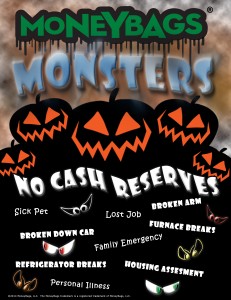

Beware the MoneyBags Monsters!!!!

Comments Off on Beware the MoneyBags Monsters!!!!It is almost here. The spookiest time of year……………Halloween!!!

When I reflect back on my childhood memories of this creepy holiday, I have several memories. As a kid, what a cool day! Not only do you get to dress up as your favorite character, but you go knocking on doors for free CANDY!!! Plus, for several years I would march in a night parade with my baton group. We had cool glow sticks taped onto our batons so people could see our awesome skills and the older girls twirled FIRE! I always liked this parade, well, that is until the one year the grim reaper came up from behind and scared me of out my shoes! Then, going forward, I was super skittish and always checking over my shoulder for creepers.

As I got older, the holiday just kept getting scarier. When I was in high school, Southern Illinois was the Halloween capital team project management tools. Every year, they would have a record breaking number of people make the trip down to SIU’s campus for their street party. I loved walking through the crowds looking at all of the costumes and just the sheer number of people that came for the holiday. I am excited all over again, since I have found the Disney of haunted hayrides – The Dead End Hayride in Wyoming, Minnesota. Last week I enjoyed the scary and creepy hay ride and maze.

As an advisor, when Halloween arrives, I think of the Money Monsters! Money Monsters are the sneaking creepy things that seem to take money out of your pocket, such as a car that breaks down, or a sick pet that needs to go to the vet. Sometimes, it may be a lost job, or maybe medical bills. The good news is, like garlic for a vampire or a night light for the ghosts in the closet, the best way to chase away the Money Monsters is to build a good cash reserve. Once you have a pool of money set aside for the unexpected surprises, like the grim reaper that scared me, if you are prepared (looking over your shoulder), it makes the Money Monsters look like someone dressed up in a costume.

Parents, this is a great time of year to sit down with your kids and walk them through the Money Monsters and the power that cash reserves has over them. To help your kids anchor this lesson, consider taking some time out of your busy schedule and play a board game that involves money (Chapter 14), such as Monopoly, Pay Day, or Life. As you play the game, talk to them about the amount of cash that they have and to plan ahead for problems that they may run into in a couple of turns. To ensure that the games teach good money habits, make sure to click on the Resources tab and print off the MoneyBags game tweaks.

Here is to filling your MoneyBags!!!

Wendy