Category Archive: Book Related

-

WJPF Miller in the Morning

Comments Off on WJPF Miller in the Morning12/22/2014 Updated Post

Wendy did appear on the Miller in The Morning Show to discuss MoneyBags, but sadly the audio for the show was lost. Instead, here is a picture of Wendy getting ready for her on air debut. We hope you enjoy!

-

MoneyBags on the radio!

Comments Off on MoneyBags on the radio! Hello MoneyBags Managers! In case you missed the live radio broadcast of Wendy Gillespie, MBA, CFP® chatting about MoneyBags: A Guide to Teaching Your Kids About Money on David England’s Eye on the Market radio show, all is not lost.

Hello MoneyBags Managers! In case you missed the live radio broadcast of Wendy Gillespie, MBA, CFP® chatting about MoneyBags: A Guide to Teaching Your Kids About Money on David England’s Eye on the Market radio show, all is not lost.Our friends at Eye on the Market have posted the segments for your listening pleasure and convenience. After speaking about MoneyBags, Wendy also has a discussion about retirement planning. Take a listen to the segments below and don’t forget to share with your friends. Click the title name of this blog post to enter the post and click one of the sharing options: Facebook, Twitter or Pinterest.

S

egment 2

egment 2

Special guest-author Wendy Gillespie MBA, CPF answers questions about writing her book MoneyBags: A Guide to Teaching Your Kids About Money. http://goo.gl/AEmZuU

Segment 3

Wendy Gillespie answers a critical question-What is it that Investors do not get when dealing with planning for retirement? http://goo.gl/sL2bHcHere’s to filling your MoneyBags!

-

Surviving Cancer and the Money Hierarchy Cake

Comments Off on Surviving Cancer and the Money Hierarchy Cake Since my book was published, much has happened as the months have ticked away. You may have noticed that my blog posts have been rather sporadic. It was my intent to at least connect with you monthly, but as we all know, life happens. The day that I receive the first copy of MoneyBags in my hand, during my celebratory lunch, I received a call from my doctor who informed me that I had several worrisome abnormal lymph nodes in my chest. This did not come as a large surprise, since the doctor had been running several test on me to find out what was causing my weak vocal cord, which in turn, caused my voice to drop down to a whisper. As she ruled things out, it finally became clear that I had Lymphoma.

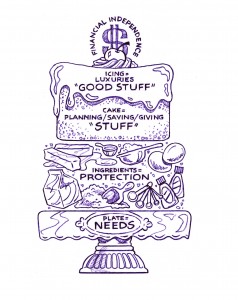

Since my book was published, much has happened as the months have ticked away. You may have noticed that my blog posts have been rather sporadic. It was my intent to at least connect with you monthly, but as we all know, life happens. The day that I receive the first copy of MoneyBags in my hand, during my celebratory lunch, I received a call from my doctor who informed me that I had several worrisome abnormal lymph nodes in my chest. This did not come as a large surprise, since the doctor had been running several test on me to find out what was causing my weak vocal cord, which in turn, caused my voice to drop down to a whisper. As she ruled things out, it finally became clear that I had Lymphoma.After I was diagnosed, I took a step back and was grateful for all the insurance (ingredients) I purchased on myself for such a scenario. Chapter 7 talks about the Money Hierarchy Cake. Level 2 is the Ingredients Level, which is where you pick up insurance. I immediately began taking an inventory of my insurance. Not only did I look at medical, but also life, and disability insurance. It should be no surprise to you, but I am also glad that I have my “old lady insurance” (i.e. long term care) in place too. Working in the insurance industry, it is hard for me to comprehend that my health went from super preferred nonsmoker (the best health rating) to uninsurable (not eligible for coverage) over night.

Like everyone else, I don’t like dishing out the money to pay for the insurance premiums, thinking I would never use it. However, logically I knew it was better to pay the premiums than to have something happen and no coverage in place.

As I reviewed all of my policies in detail, I can tell you that I had peace of mind knowing that if I had to walk away from being a financial advisor and unknown author, that financially, I was going to be just fine. Furthermore, I looked at what would happen if I were to die. Sadly, I don’t have kids, it was not in the cards for me, but I do have a substantial amount of life insurance on me for many reasons. I always joke with my clients that if I die young (when my insurance premiums are cheap) that someone should win the lottery. When I review the beneficiary designation on my life insurance policies, I think about what an impact I can make on where I decide to distribute the money. Even though my parents don’t need the money, I can ensure that they will not need money if I am gone. I have some charities that I allocate to as well as people who are important to me.

Gratefully, I am happy to report that not only am I now cancer free after six rounds of chemo therapy, but I also have regained my voice. Going forward I have a lot of ground to cover. I am looking forward, with your help, in helping parents teach their kids about money, by spreading the word about MoneyBags!

Here is to filling your MoneyBags!!!

Wendy

-

Tetherball of Success – A New MoneyBags Moment

Comments Off on Tetherball of Success – A New MoneyBags Moment As I write this I have a HUGE smile on my face. I am sitting on the porch listening to my neighbors (both parents and kids) laughing as they play with the new tetherball in their backyard. This tetherball is very special, since they told me that they bought it with their Family Saving Jar money (Chapter 2)! Woohoo! Way to save that change and create a MoneyBags Moment!

As I write this I have a HUGE smile on my face. I am sitting on the porch listening to my neighbors (both parents and kids) laughing as they play with the new tetherball in their backyard. This tetherball is very special, since they told me that they bought it with their Family Saving Jar money (Chapter 2)! Woohoo! Way to save that change and create a MoneyBags Moment!

-

My Sister’s MoneyBags Moment

Comments Off on My Sister’s MoneyBags Moment<img class="alignleft" style="width: 269px; height: 189px;" alt="MoneyBags Moment, Pennies" src="http://moneybagslife best team management apps.com/wp-content/uploads/2014/04/4-20BlogPic-300×238.jpg” width=”300″ height=”238″ />My sister has a rewarding job, as a Foster Care Case Manager working directly with foster kids, but today I got a frustrated text from her asking for some wisdom. Basically, one of her foster kids traded two video games ($50) for a bag of chips ($1) and of course she felt he got a bad deal. Did he? I think he was hungry and negotiated with something that did not meet his primary needs (The Plate Level of the Money Hierarchy Cake – Chapter 7). So for him, it was better to eat than to keep the games.

However, I also see my sister’s concern and desire to help, protect, and nurture him. I told her that this is a cheap mistake. It’s a MoneyBags Moment. She now needs to explain to him that both items have a dollar value and she needs him to understand the dollar amount of each item. A poor trade is one bag of chips ($1) for two video games ($50). A fair trade would be 50 bags of chips ($50), for the two games ($50), a good trade is 60 bags of chips ($60), and an awesome trade would be for a semi-truck full of chips ($1500). The sooner he learns this the better he will be a making deals (Chapter 46- Bartering).

Here is to filling your MoneyBags!

Wendy

-

Delayed Gratification — MoneyBags is printing as I type!

Comments Off on Delayed Gratification — MoneyBags is printing as I type!

I started this unexpected journey in early 2009. I was surprised when I saw a good friend, who was smart and a good parent, but he struggled when teaching his kids the basics in how to handle and think through money decisions. I then looked back at his upbringing and it all made sense, he only knew what he was taught by his parents and he was passing his limited knowledge on to his kids. So, I began feverishly writing all the things that I had learned. The lessons just poured out one right after another. Pages and pages of money lessons, but then I ran into a couple of problems, there is so much to know and how do I organize the information? More importantly, how do I make it simple and fun?

I then went to my good friend and executive coach at the time, Nancy Imholt, and explained to her this need I had in writing this book. She listened, smiled and got it! She saw a bigger vision than I could at the time. Then my passion became a dream.

I spent my spare time over the next couple of years, writing, researching, obtaining feedback, making changes, began blogging, and focusing on completing the book. At times, the finished product seemed so close, but then there would be a setback, from having no time for writing, to editors that did not connect to me or my vision. Through Nancy, I found my publisher, which linked me up to key people to help me through the process from editors to book designers, and so on. I also had to seek out people on my own to design the logo, web site, illustrations, and other countless tasks.

I was also blessed with cheerleaders. Many of my friends and colleagues have been encouraging, positive, and even anxious as they look forward to the completion of the book I have been talking about for so long. Carlos Rodriguez and Amber Appel have been my biggest supporters. They joined MoneyBags LLC, even though there is not a penny of profit. Their help, input and support is priceless! Also, my future success of the book now depends on me being able to take a little more time away from the office, so I am grateful for Carla Keck, who is my right hand and has my back at every turn. With her at the wheel, I can confidently take time to spread my vision.

So, after many years and numerous edits, within in a few short days the book will be complete. The website will be live. I feel like a little kid at Christmas. I am about to burst from the excitement and anticipation of the long awaited arrival of MoneyBags in my hands. Oh, the overwhelming feeling of delayed gratification! This important money lesson is covered in Chapter 25 of the book. It talks about the famous researcher, Walter Mischel, and his marshmallow test. It explains his findings and the importance of having self-discipline to not always grab, but to realize the bigger reward for waiting.

Here is to filling your MoneyBag!

Wendy

-

The MoneyBag Threshold

Comments Off on The MoneyBag Threshold Today is a brisk November day and it has been a long time since I have updated my blog project team management. Like my clients, the start of the fall (or school year) tends to make the days run faster. Though I would like to say I have had excellent progress on the book, the reality is I am still holding all of the cards, but have begun to make some decision and begun to push things out the door.

Today is a brisk November day and it has been a long time since I have updated my blog project team management. Like my clients, the start of the fall (or school year) tends to make the days run faster. Though I would like to say I have had excellent progress on the book, the reality is I am still holding all of the cards, but have begun to make some decision and begun to push things out the door.My motivation today, is to explain how important it is to have savings put on autopilot (pay yourself first to your 401(k) plan, savings or piggy bank) because once you have a system set up it happens without you realizing…then the months go by faster than a blink of an eye. If you have no system in place to automatically save, then those months

have added nothing to your savings. But, if you save $100 a month on autopilot and six months have gone by in a blink of an eye, you now have $600!Furthermore, when you do take time, like I did today, to assess how things are going, it is a perfect time to see if you should increase your savings from $100 a month to $150! That way when the next six months flies by you have now saved $900!

This type of behavior allows you to crossover your MoneyBags Threshold. To me, this is that point in time, where you suddenly see your money at work versus you working for your money. For some people, this occurred when they learned about interest and dividends. For others, it is when they see their discipline of saving money over time actually accumulate to a large sum. No matter when the crossover of the MoneyBags Threshold occurs for you, when you reach it, it mean you have become excited about saving money and begin to think of ways to save more versus spend more.

So, today make sure to stop and make a conscious decision on automating your savings, pay yourself first. If you are already committed to this step, now go a step further and twist the proverbial MoneyScrews and increase the amount you save, even if it feels tight, increase it by $5, $10, $50, or more!

Here is to filling your MoneyBags!

-

Fast Times at MoneyBags

Comments Off on Fast Times at MoneyBagsThis month my life reflects the stock market — changing quickly. The book is moving fast and I am the one holding all the hot potatoes. Not only has the editor returned the book for my final review, which is a scary thing for someone who is scared of commitment, but I also have the first cover illustration back from the illustrator over here. The public relations person and I are also looking into whom to request for the foreword and “blurbs” to put on the back cover.

Today was rough feeling under the gun really kills the creative juices, but I have to take a step back to see how far things have come. Carlos and Amber have created my money tree, mocked a moneybag, and we have begun getting the web site/blog to look more structured. Any day my business cards and stationary will arrive and I got a new number for the business!

This week was especially rewarding since I ran into a fellow author at Beaver’s Pond Press. He gave me pointers and offered to do a blurb! We talked for awhile about what his journey as an author was like and what he would do differently if he had it to do all over again.

Here is my tip for you this posting. As you start getting ready for your kids to go back to school have this be a time that they see you budget for school expense. Tell them how much you need to allocate for back to school clothes and supplies and have your kids actively help you stay within your goal when you go shopping. As a new tradition on your kids first day of school in addition to taking their picture on the front steps, consider having your kids count and track how much they have in their long-term savings.

Here is to filling your MoneyBags!

Wendy

-

The Month of Independence

1 Comment Things are starting to move fast! I have a meeting scheduled with the illustrator of the book on the 26th and the manuscript will soon return from the editor for my review. The logo has been created and is on its way to be trademarked! In the meantime summer is ticking away and my business calendar is jam packed for August!

Things are starting to move fast! I have a meeting scheduled with the illustrator of the book on the 26th and the manuscript will soon return from the editor for my review. The logo has been created and is on its way to be trademarked! In the meantime summer is ticking away and my business calendar is jam packed for August!As discussed in my last blog, it is a good thing I practice discipline. It has been a while and I am rusty. If, like me, you are not used to giving something up for 40 days and have never done so than working into it is a better option. Hence, start slow with your kids by only give something up for a week. Then, down the road try it again for two weeks, than four weeks, and then 40 days! Make sure you are very clear on what you are giving up (for example, carbohydrates or potatoes and bread). You want your kids to see the light at the end of the tunnel, but still make it a challenge. Consider a reward outside their personal accomplishment of discipline by doubling their allowance during the discipline period or let them be in charge of picking the family meals.

Lastly, a failure may not be a failure. It could actually be a point where your kids stop and evaluate the situation. They may feel the practice of giving something up is more important and they will continue with their goal of discipline (that is a good option), but they may also decide to cave, like I did, when it was someone’s birthday. Either way, they are learning something. Hopefully, they are learning flexibility. However, if they buckle every day, you know that they are not learning discipline and you need to continue to challenge their behavior so that they can see the reward of delayed gratification.

Since this is the month of independence (notice no school during the month of July), consider having your kids tell you what they most value from the freedom they experience in by living in the USA and why. Explain to your kids what financial freedom means to you and ask them how would they feel if they were financially free? What would they do with their time and money if they were financially free?

Here is to filling your MoneyBag!

Wendy

-

3….2….1….

Comments Off on 3….2….1….And a way we go!!!!

Monday everything became official, I forward my book to the editor!!!! Today is a beautiful day outside and I am for the first time a loss of what to do with my time. Do I make it a day of errands, round up some friends for lunch, take a long walk, clean out the garage, or visit a coffee shop with no writing agenda?

One thing I am doing is to actually practicing what I preach. One recommendation in the book is to practice discipline, like some religions, by giving up something for 40 days. I figured if I am going to put it in the book, I should try it for myself. Looking for a win-win, I decided to give up carbs to help me lose weight! I am on day four and have cheated once due to a birthday party at my office. After all, how can you say no to birthday cake?

Here is to filling your Moneybag!

Wendy