Tag Archive: Teaching Kids

-

-

Mom’s Choice Award Winner

Comments Off on Mom’s Choice Award WinnerIt is official! “MoneyBags A Guide to Teaching Your Kids About Money” has won two Mom’s Choice Awards (MCA) – Gold , in both the Adult Books and Educational Products categories!

“The MCA evaluates products and services for children and parents. The program is globally recognized for establishing the benchmark of excellence in family-friendly media, products and services. The organization is based in the United States and has evaluated thousands of entries from more than forty countries.”

After a rigorous evaluation I am both honored and excited that MoneyBags received the highest awards in both categories entered. Going forward, the book and website can display their respected logo.

Thank you for all your support so early in my journey to education kids about money. Please help me spread the good news by sharing this post via Facebook, Twitter and Pinterest!

Here is to filling your MoneyBags!

Wendy

-

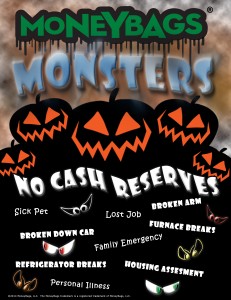

Beware the MoneyBags Monsters!!!!

Comments Off on Beware the MoneyBags Monsters!!!!It is almost here. The spookiest time of year……………Halloween!!!

When I reflect back on my childhood memories of this creepy holiday, I have several memories. As a kid, what a cool day! Not only do you get to dress up as your favorite character, but you go knocking on doors for free CANDY!!! Plus, for several years I would march in a night parade with my baton group. We had cool glow sticks taped onto our batons so people could see our awesome skills and the older girls twirled FIRE! I always liked this parade, well, that is until the one year the grim reaper came up from behind and scared me of out my shoes! Then, going forward, I was super skittish and always checking over my shoulder for creepers.

As I got older, the holiday just kept getting scarier. When I was in high school, Southern Illinois was the Halloween capital team project management tools. Every year, they would have a record breaking number of people make the trip down to SIU’s campus for their street party. I loved walking through the crowds looking at all of the costumes and just the sheer number of people that came for the holiday. I am excited all over again, since I have found the Disney of haunted hayrides – The Dead End Hayride in Wyoming, Minnesota. Last week I enjoyed the scary and creepy hay ride and maze.

As an advisor, when Halloween arrives, I think of the Money Monsters! Money Monsters are the sneaking creepy things that seem to take money out of your pocket, such as a car that breaks down, or a sick pet that needs to go to the vet. Sometimes, it may be a lost job, or maybe medical bills. The good news is, like garlic for a vampire or a night light for the ghosts in the closet, the best way to chase away the Money Monsters is to build a good cash reserve. Once you have a pool of money set aside for the unexpected surprises, like the grim reaper that scared me, if you are prepared (looking over your shoulder), it makes the Money Monsters look like someone dressed up in a costume.

Parents, this is a great time of year to sit down with your kids and walk them through the Money Monsters and the power that cash reserves has over them. To help your kids anchor this lesson, consider taking some time out of your busy schedule and play a board game that involves money (Chapter 14), such as Monopoly, Pay Day, or Life. As you play the game, talk to them about the amount of cash that they have and to plan ahead for problems that they may run into in a couple of turns. To ensure that the games teach good money habits, make sure to click on the Resources tab and print off the MoneyBags game tweaks.

Here is to filling your MoneyBags!!!

Wendy

-

WJPF Miller in the Morning

Comments Off on WJPF Miller in the Morning12/22/2014 Updated Post

Wendy did appear on the Miller in The Morning Show to discuss MoneyBags, but sadly the audio for the show was lost. Instead, here is a picture of Wendy getting ready for her on air debut. We hope you enjoy!

-

Book Signing: September 22, 2014, at Carterville Library

Comments Off on Book Signing: September 22, 2014, at Carterville Library On September 22, 2014, from 4 PM until 7 PM, visit the Anne West Lindsey District Library in Carterville, IL, for a MoneyBags book signing event. Wendy Gillespie, MBA, CFP®, and the MoneyBags staff will be on hand to sell and sign copies of MoneyBags: A Guide to Teaching Your Kids About Money. Invite your friends and come share your favorite MoneyBags Moment!

On September 22, 2014, from 4 PM until 7 PM, visit the Anne West Lindsey District Library in Carterville, IL, for a MoneyBags book signing event. Wendy Gillespie, MBA, CFP®, and the MoneyBags staff will be on hand to sell and sign copies of MoneyBags: A Guide to Teaching Your Kids About Money. Invite your friends and come share your favorite MoneyBags Moment! -

TV Appearance: WSIL TV

Comments Off on TV Appearance: WSIL TV Watch Wendy Gillespie, MBA, CFP® appearance on the WSIL TV’s morning show on September 22, 2014. Together with Jalay Gray they discuss Wendy’s book “MoneyBags: A Guide to Teaching Your Kids About Money” during the morning show.

Watch Wendy Gillespie, MBA, CFP® appearance on the WSIL TV’s morning show on September 22, 2014. Together with Jalay Gray they discuss Wendy’s book “MoneyBags: A Guide to Teaching Your Kids About Money” during the morning show.Click on the link to watch:

-

Book Signing: Southern Illinois Women’s Health Conference

Comments Off on Book Signing: Southern Illinois Women’s Health Conference Join Wendy on September 20, 2014, for a MoneyBags book signing event sponsored by John Forbes of Forbes Financial Group. Wendy will be signing copies of MoneyBags: A Guide to Teaching Your Kids About Money from 7:30 to 8:15 am at the Southern Illinois Women’s Health Conference on the John A. Logan College campus in Carterville, Illinois.

Join Wendy on September 20, 2014, for a MoneyBags book signing event sponsored by John Forbes of Forbes Financial Group. Wendy will be signing copies of MoneyBags: A Guide to Teaching Your Kids About Money from 7:30 to 8:15 am at the Southern Illinois Women’s Health Conference on the John A. Logan College campus in Carterville, Illinois.For more information about the Women’s Health Conference or to register for the event, please visit www.w4hw.com.

For information on Forbes Financial Group , please visit www.ForbesFinancialOnline.com.

For information on Forbes Financial Group , please visit www.ForbesFinancialOnline.com. -

The Cost of Clutter and Explaining it to your Kids

Comments Off on The Cost of Clutter and Explaining it to your Kids

Money Manifesters!!!

Today I was reading a great article by Amanda Enayati titled “Why Clutter Matters and De-cluttering is Difficult.” In the article, she states that clutter is expensive and costs an average of $10 per square foot just to store items. Approximately 10% of the population spends $1,000 a year on storage units. Of the people that have two car garages, 25% are too full for the owners to their park cars! Sadly, 23% of people pay bills late and incur fees due to misplaced/lost statements. Overall, an average American spends a year of their life looking for misplaced items. Explain the cost of clutter to your kids.

As a fun exercise, go a step further with your kids and talk about all the “stuff” in your garage/basement. Ask them to think about how much you paid for all that “stuff!” Make a game of it. Pick out 10-30 items and have everyone write on a sheet of paper, what they think was spent on all of the items in total. Then make the game into a scavenger hunt. Have your kids make a list of all the “stuff” in your garage/basement (the items that you have picked out). (Note: Each kid can have the same lists or you can have them look for separate items.) Then go to the store(s) and have the kids locate and write down the price of the different items. For example, maybe your list has four lawn chairs, two bikes, grill, lighter fluid, coals, five gallons of paint, potting soil, 25 planting pots, lawn mower, etc. After your trip, have your kids total up their lists and see who was closest to the total guess that was written on the paper. Ask them what they learned like this. Were they surprised at the cost of all the stuff? How much would you have to pay in taxes? Calculate tax of 5%, 8%, and 10%. How often is the stuffed used? Is the “stuff” in good shape or has it been damaged or neglected? How many weeks would it take your kids to save their full allowance to pay for all that “stuff” (including taxes 10%)? How would it feel to have the money spent on all the “stuff” inside their MoneyBag instead?

Here is to filling your MoneyBag!

Wendy