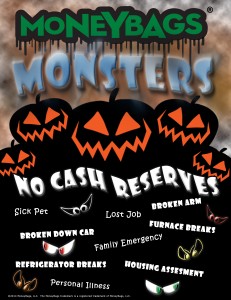

Beware the MoneyBags Monsters!!!!

Comments Off on Beware the MoneyBags Monsters!!!!It is almost here. The spookiest time of year……………Halloween!!!

When I reflect back on my childhood memories of this creepy holiday, I have several memories. As a kid, what a cool day! Not only do you get to dress up as your favorite character, but you go knocking on doors for free CANDY!!! Plus, for several years I would march in a night parade with my baton group. We had cool glow sticks taped onto our batons so people could see our awesome skills and the older girls twirled FIRE! I always liked this parade, well, that is until the one year the grim reaper came up from behind and scared me of out my shoes! Then, going forward, I was super skittish and always checking over my shoulder for creepers.

As I got older, the holiday just kept getting scarier. When I was in high school, Southern Illinois was the Halloween capital team project management tools. Every year, they would have a record breaking number of people make the trip down to SIU’s campus for their street party. I loved walking through the crowds looking at all of the costumes and just the sheer number of people that came for the holiday. I am excited all over again, since I have found the Disney of haunted hayrides – The Dead End Hayride in Wyoming, Minnesota. Last week I enjoyed the scary and creepy hay ride and maze.

As an advisor, when Halloween arrives, I think of the Money Monsters! Money Monsters are the sneaking creepy things that seem to take money out of your pocket, such as a car that breaks down, or a sick pet that needs to go to the vet. Sometimes, it may be a lost job, or maybe medical bills. The good news is, like garlic for a vampire or a night light for the ghosts in the closet, the best way to chase away the Money Monsters is to build a good cash reserve. Once you have a pool of money set aside for the unexpected surprises, like the grim reaper that scared me, if you are prepared (looking over your shoulder), it makes the Money Monsters look like someone dressed up in a costume.

Parents, this is a great time of year to sit down with your kids and walk them through the Money Monsters and the power that cash reserves has over them. To help your kids anchor this lesson, consider taking some time out of your busy schedule and play a board game that involves money (Chapter 14), such as Monopoly, Pay Day, or Life. As you play the game, talk to them about the amount of cash that they have and to plan ahead for problems that they may run into in a couple of turns. To ensure that the games teach good money habits, make sure to click on the Resources tab and print off the MoneyBags game tweaks.

Here is to filling your MoneyBags!!!

Wendy